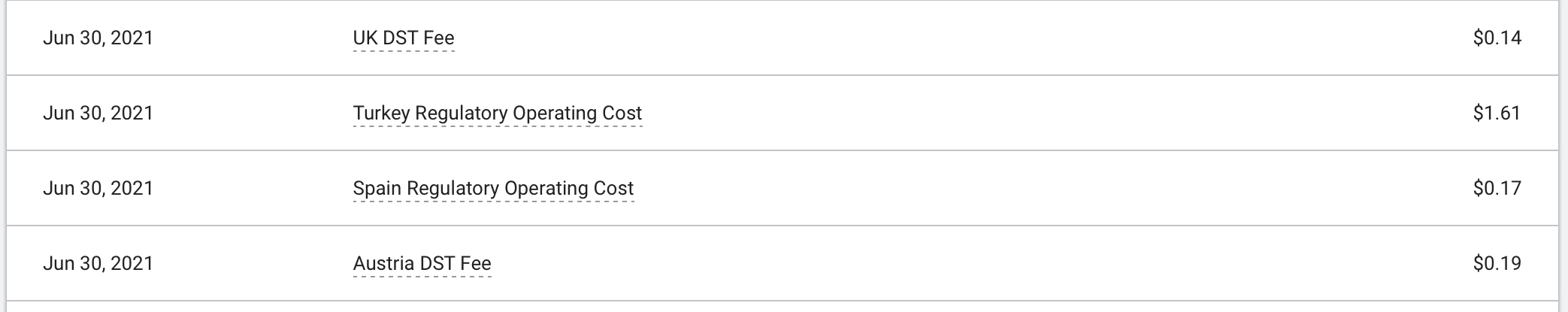

Have you noticed new line items in your Google Ads invoices or statements that look like this?

So what is the UK DST fee? Since November 1st, 2020, Google Ads has charged customers the tax required to pay in certain countries that have passed Digital Service Tax policies for digital advertising. Google calls this pass-through tax a jurisdiction-specific surcharge on your invoice. It is a percentage of the click cost of ads purchased through Google Ads and YouTube placements purchased on a reservation basis shown in seven countries in Europe and Asia. Google describes these fees as either a Digital Service Tax (DST) or a Regulatory Operating Cost (ROC).

DSTs and ROCs are separate from Value Added Tax (VAT) levied in your specific country.

List of countries with Google Ads Jurisdiction-specific surcharges:

- Austria

- France

- India

- Italy

- Spain

- Turkey

- United Kingdom

Where to find these surcharges?

You can see the surcharges in either of the following places in your Google Ads account:

- In your monthly invoice or statement as a separate line item per jurisdiction.

- In the “Transactions” section of your Google Ads account:

- To view a DST Fee or a Regulatory Operating Cost, click the tool icon, and under “Billing,” choose Summary, then click Transactions from the menu on the left.

My customers aren’t in Europe. Why am I being charged these fees?

Google applies these surcharges for traffic originating from countries with DSTs. For example, you may not be targeting Austria specifically; someone searching for your services may see your ads in Austria.

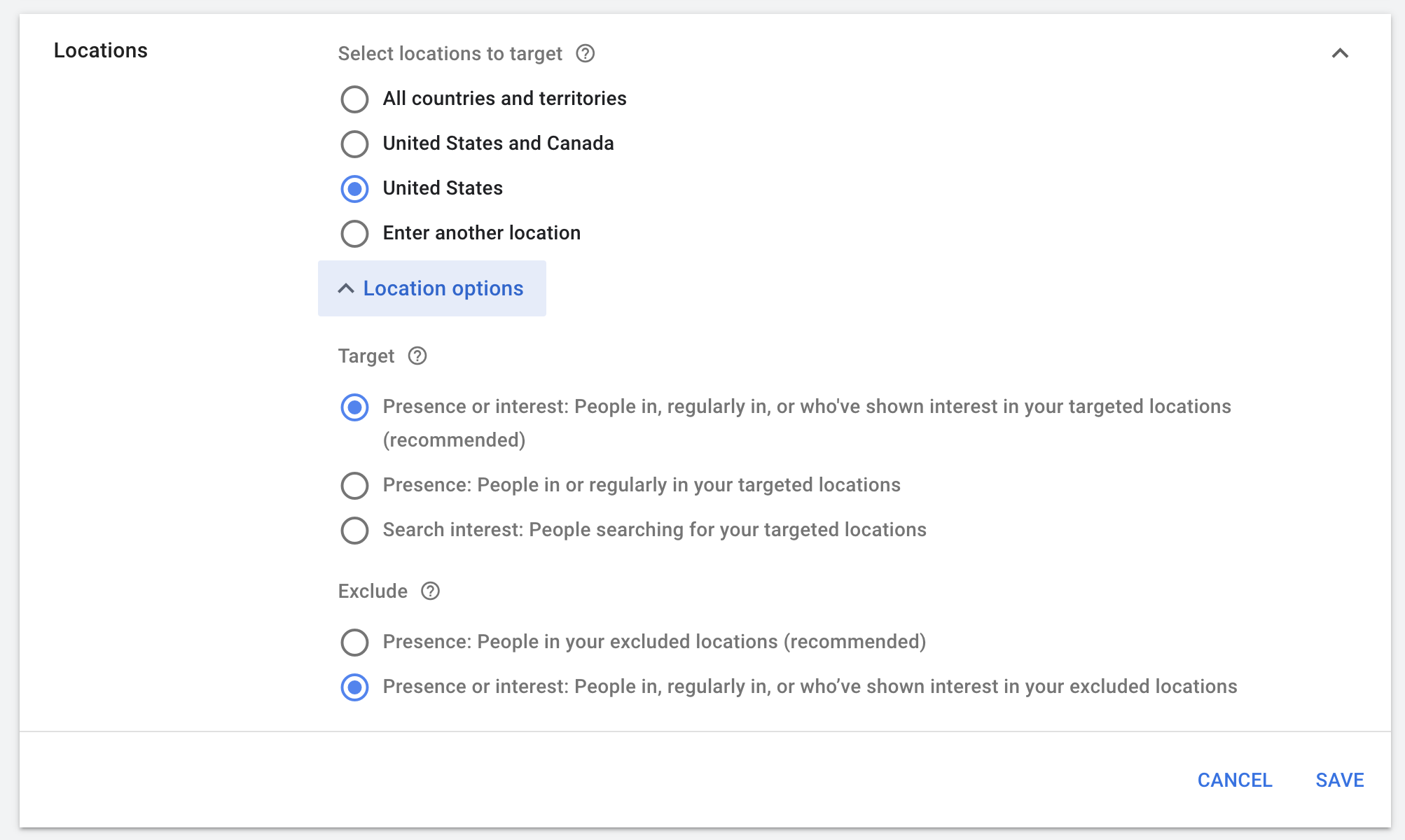

Part of the answer lies in the targeting options in your campaign settings. Google offers these three options:

- target “people in, or who show interest in, your targeted locations” (Presence or Interest)

- target “people in or regularly in your targeted locations” (Presence)

- target “people searching for your targeted locations” (Search interest)

When you first set up your campaigns, Google Ads defaults targeting to Presence or Interest. Therefore, you may have those in other countries clicking on our ads, including those with DST fees.

How do I avoid Google jurisdiction-specific fees?

If your ads target any of the countries listed above, you cannot avoid the fee. Google Ads will automatically add the surcharge for any traffic costs from those countries as a separate line item on your invoice added at the end of every month.

However, if you’re not targeting these countries, there are two ways where you can avoid the fee by adjusting to your campaign settings, one more effective than the other.

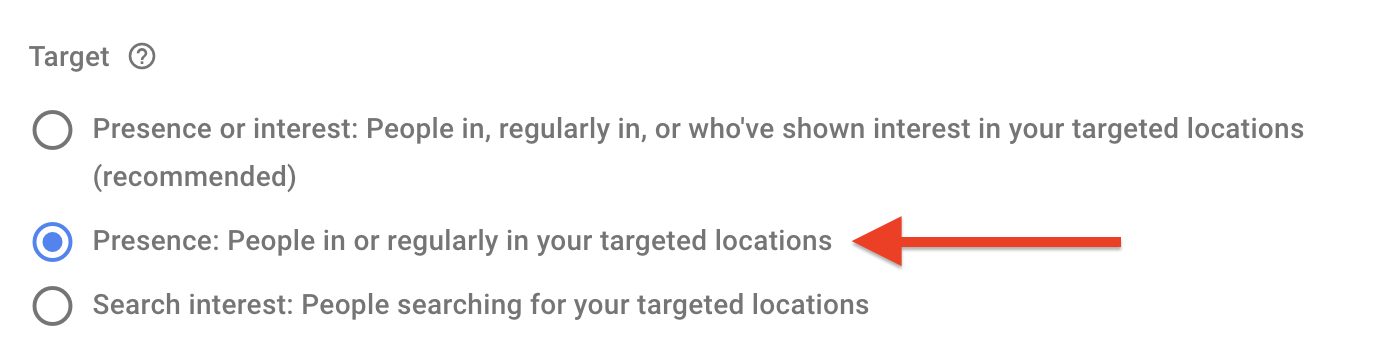

1. Update your search targeting in your campaigns

Change your targeting options to target “people in or regularly in your targeted locations,” which will hone your targeting to those who are presently in your location target. While a good solution, it’s not 100% as you may have a business traveler from the UK who is regularly in your targeted area looking for services. When the visitor returns home and searches using a UK IP address, they will still be subject to that tax.

2. Exclude countries with DSTs from your campaigns

Excluding countries is the most effective way to avoid the DST and ROC fees as you exclude traffic entirely from specific countries.

How to batch countries exclusions

If you’d like to exclude multiple countries in bulk, Google Ads allows you to add a list of up to 1000 location exclusions at a time, rather than adding each country one-by-one.

To exclude multiple areas within the locations you’ve selected, follow these steps:

- From the page menu on the left, click Campaigns.

- Click the name of the campaign you wish to edit.

- Click Settings.

- Expand the “Locations” section from the settings menu, and click Advanced search.

- Check the box next to “Add locations in bulk.”

- In the box, paste or type the names of the countries that you’d like to exclude. Add locations from one country at a time. See the list of targetable locations.

- You can choose to “Restrict locations within a country.”

- Once you’ve entered your locations, click Search.

- All locations that matched your search will display in the review panel. Review your results, and click Exclude all. Under the section “Excluded locations,” you’ll see the locations that you’ve just excluded.

- Click Save.

- Once you’ve confirmed your changes, click Save on the Settings page.

If you select “Show locations on map”, your excluded countries will also appear with a red outline on the map.

Note: You will need to apply these settings for every campaign in your account as there are no account-level settings for location targeting.

What are the Google Jurisdiction-specific fees by country?

| Country | Fee | Starting Date |

| Austria | 5% | November 1, 2020 |

| France | 2% | May 1, 2021 |

| India | 2% | October 1, 2021 |

| Italy | 2% | October 1, 2021 |

| Spain | 2% | May 1, 2021 |

| Turkey | 5% | November 1, 2020 |

| United Kingdom | 2% | November 1, 2020 |

Why is Google charging jurisdiction-specific fees?

While these tax regulations were designed to collect revenue from digital media companies like Google and Facebook, Google has decided to pass this fee through to their customers.

What is a DST (Digital Services Tax)?

A DST stands for Digital Service Tax which several countries use to collect tax revenue in the digital economy. Talk of a DST started within the European Union in 2018 as a way for member states to collect revenue from large multi-national corporations operating within their borders.

While the EU did not create a blanket DST for all European Union member countries, several countries inside the EU created their own tax policies for digital media. They vary in application — some countries like Austria only charge the tax on online advertising, and Belgium exclusively targets selling user data.

Do other digital advertising companies pass the DST to their customers?

- Facebook does not pass the DST to their customers.

- Microsoft does not pass the DST to their customers.

- Amazon charges a blanket 2% to all customers serving in affected countries

Are there additional countries considering a DST?

- Czech Republic – proposed at 5% DST on targeted advertising, although now delayed due to the COVID-19 pandemic.

- Hungary – implemented a 7.5% DST on advertising revenue, but has been reduced to 0% through December 31, 2022

- Latvia – Investigating a 3% DST

- Norway – Possibly in 2021

- Slovakia – Discussed in 2020, but no further discussions.

- Slovenia -Discussed in 2020, but no further discussions.